|

|

|

March 1st, 2026 at 01:58 am

Time to update my net worth and also update you on the situation in Minneapolis. I know we're slipping out of the headlines what with the Iran attack and Epstein files and everything, but ICE/Border Patrol have not left MN as what's-his-face the "czar" claimed. There are still over 1K agents here. The noise and violence isn't as constant but it's still here. My BFF's sister went over to the building where they detain people; there are lots of helpers there because even if someone is documented and released without charges, they just throw them out into the cold, often without their phone, so people help them get home and contact family. Anyway, my BFF's sister was helping translate for a Venezuelan legal resident who got released and he had a badly broken wrist from his treatment in detention. I'm sure the other 2K agents who aren't here anymore are spreading throughout the states, causing trouble and making communities less safe, which is their real mission.

Anyway, here's our net worth update. I turn 52 on Monday so I thought I'd update my age in the Coast FIRE calculator; even with having a higher Coast number we're still over $200K ahead of where we need to be, so that's a bit of good news.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 41,722 pounds |

$52,153 |

|

|

| AV2: 8,462 pounds |

$10,578 |

|

|

| NT's trad. rollover IRA |

$164,456 |

|

|

| NT's Roth IRA |

$109,751 |

|

|

| NT's SEP IRA |

$9,514 |

|

|

| NT's AAC acct |

$17,350 |

|

|

| AS's trad. rollover IRA |

$41,003 |

|

|

| AS's Roth IRA |

$156,086 |

|

|

| AS's SEP IRA |

$110,523 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$343,601 |

|

|

| CJ's Roth IRA |

$118,523 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,338,283 |

retirement only: |

$1,170,803 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$318,202 |

|

|

| Rental property mortgage |

$367,695 |

|

|

| HELOC |

$26,600 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$721,497 |

|

|

| |

|

|

|

| Current Estimated Net Worth February 2026 |

$1,616,786 |

|

|

| |

|

|

|

| January 2026 estimate: |

$1,595,809 |

|

|

| |

|

|

|

| Change in net worth |

$20,977 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,170,803 |

|

|

| Coast FIRE number at current age |

$954,913 |

|

|

| Current status: at Coast FIRE with surplus: |

$215,890 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

5 Comments »

February 1st, 2026 at 11:11 pm

We continue to live in chaos in Minneapolis. Despite Bovino leaving and various officials talking about de-escalation, things are possibly even worse. They move from neighborhood to neighborhood like locusts targeting every person of color they can find. They often sweep up observers regardless of race as well, slapping them with trumped-up or sometimes just holding them for a day or two in horrible conditions before releasing. They pepper spray and tear gas at will.

My non-white kid V had already opted for online school out of fear. Now he's starting to withdraw from extracurricular activities as well. He's a social kid so this is taking a toll.

My non-white wife AS is very hesitant to leave the house alone. She usually will go if one of us white folks can accompany her.

It's like the opposite of the military being sent to the South to desegregate. It's the feds coming in to force separate and unequal conditions on a population that does not want segregation. And in a biracial family that is painful. I implore you to call your congress and tell them not to give ICE/DHS/CBP any more money until they stop this siege.

Anyway, we continue to soldier on with life and work as well as we can. I've had a quiet month for our business but I'm glad of that, even if it means we scramble financially later. It's hard to concentrate or give a shit about the corporate stuff I write about for a living.

At least our net worth is still looking good with a healthy surplus for CoastFIRE for now.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 41,722 pounds |

$52,153 |

|

|

| AV2: 8,462 pounds |

$10,578 |

|

|

| NT's trad. rollover IRA |

$161,522 |

|

|

| NT's Roth IRA |

$107,789 |

|

|

| NT's SEP IRA |

$9,342 |

|

|

| NT's AAC acct |

$16,611 |

|

|

| AS's trad. rollover IRA |

$40,274 |

|

|

| AS's Roth IRA |

$153,274 |

|

|

| AS's SEP IRA |

$108,546 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$337,694 |

|

|

| CJ's Roth IRA |

$116,403 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,318,931 |

retirement only: |

$1,151,451 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$319,157 |

|

|

| Rental property mortgage |

$368,365 |

|

|

| HELOC |

$26,600 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$723,122 |

|

|

| |

|

|

|

| Current Estimated Net Worth January 2026 |

$1,595,809 |

|

|

| |

|

|

|

| December 2025 estimate: |

$1,571,996 |

|

|

| |

|

|

|

| Change in net worth |

$23,813 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,151,451 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$233,266 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

10 Comments »

January 10th, 2026 at 06:29 am

If you want to know how my week went, you just need to know I live in south Minneapolis. I was actually being an observer when I got an alert on my phone that another observer had been shot about 10 minutes drive from where I was parked keeping an eye on a suspicious vehicle idling. I rushed to that scene probably minutes after Renee Good was taken away. Ever since then everything has ramped up. Schools were closed the rest of the week after Border Patrol invaded a high school not far from my daughter's. ICE swarmed my particular little neighborhood all day today abducting people. Etc. etc. etc. Been trying to do my part and just feeling overwhelmed so I haven't gotten much done this week.

Plus we still haven't got clarity on some of the healthcare costs we were hoping to understand before we settled on annual budget targets. But I decided to make some assumptions and finalize the budget to the best of my ability.

It's an ambitious budget. We had to up our grocery, mortgage, health insurance, medical expense and summer camp categories. We chose to up our travel, spending money, kids and family fun categories. We're facing lower fixed revenue due to health premiums and mortgages eating into our income. So it's on me and AS to bring in a lot more dough. We did get an offer to both go 30 hours a week at a place for about 3-4 months in the spring which would give us a very good push toward our ambitious goal of $164K gross income in our business. (Last year we made about $110K.) We do expect some bits of income in the form of NT's side hustle, CC rewards, and maybe a few things like that, so potentially AS and I wouldn't have to make that whole amount ourselves. If the ACA pandemic credits get reinstated that would also take down that needed amount by a grand or two. We're going to go for it for a couple months and then reassess if we need to scale back some of our "wants" based on whether we seem to be in sight of that big income target or not.

I was gonna post some more detailed numbers but I'm so tired from the week, I think I'll leave it at that. Hope everyone else is having a calmer 2026 than we are so far!

Posted in

Uncategorized

|

8 Comments »

January 4th, 2026 at 08:50 pm

I finally was able to close the books on 2025--I was waiting days for NT to categorize two little transactions so I could be done!

Because of the way I work my budget it'll be a bit hard to get granular on numbers, but I'll do my best.

2025 - 2024 comparisons

In 2024 our projected budget was $71,606 in fixed income and $116,405 expected spending, which meant we need to come up with about $45K extra. Since AS and I keep 75% of our earnings, that meant we needed to make $60K. Overall, we brought in that plus some from our business and other sources (tax refunds, credit card rewards, NT's side hustle, but we overspent by $14K and had to take out about $10K on the HELOC to help cover it.

In 2025, our projected budget was $72K fixed income and $155,454 expected spending. We'd raised line items to match what we spent in 2024, and to have more money for travel and a couple other things. That meant we needed to come up with about $85K net or $116K gross.

AS and I came close, bringing in about $110K on our business, so much better than 2024. We also got $7K in other types of income such as an oil lease from some WV land. However, despite upping many of our budget line items, we overspent by quite a bit and had to borrow $17K out of our HELOC. So between 2024 and 2025, we now owe $26,700 on the HELOC.

Where did the overspending come from? A couple things would take a bit more effort to quantify, such as mortgage payments going up, just because of the way my spreadsheets and tracking work. But I can show the variable categories since I track those over the course of the year and have a final result on them, and that's where the bulk of the overspending happened.

Groceries: $16,100 budgeted; overspent by $1251

Healthcare expenses (not counting premiums): $5400 budgeted, overspent by $172

Barber & hair salon: $1440 budgeted, had $373 left over

Transportation: $2400 budgeted, had $284 left over

Subscriptions: $1200 budgeted, had $48 left over

Misc. houshold/unbudgeted costs: $4200 budgeted, overspent by $1197

Rental property expenses (not counting mortgage & utilities): $4200 budgeted, overspent by $338

Home improvement: $3,000 budgeted, had $26 left over

Vacays/travel (this was the biggie): $12,000 budgeted, overspent by $14,254

Giving: $900 budgeted, overspent by $424

Dates: $1200 budgeted, had $672 left over

Kid expenses (not counting summer camp): $3,000 budgeted, overspent by $1,290

Interest/fees: $600 budgeted, overspent by $691

Pets: $3,000 budgeted, overspent by $3,513

Family fun: $1,800 budgeted, overspent by $2,748

Camp: $6,000 budgeted, overspent by $53

The biggest thing was that we had a lot of travel that ate up our budget, but we really wanted a grownups trip to Europe which hadn't happened since 2018, so we basically put that trip on credit cards (and eventually the HELOC). The second biggest was caring for our sick cat. The third biggest overspend was family fun, various things but partly my bday party which ended up costing more than expected. And the next biggest was groceries, no surprise given inflation.

That's probably enough for one post, so I'll talk about my 2026 budget projections in a different post!

Posted in

Uncategorized

|

5 Comments »

December 31st, 2025 at 08:20 pm

Happy New Year, friends! As I wrap up 2025, I'm officially adding our HELOC debt to the spreadsheet. For the past two years I've been hoping it was a short-term loan that I could quickly pay back, but with where inflation is going, healthcare costs spiking, and me and AS still trying to build our business, I've had to acknowledge that this debt is gonna hang around a while longer. We borrowed about $10K in 2024 and $16K this year, so $26K total.

As a result of realizing all this accumulated debt, our net worth went down this month--but only by about $11K, because we paid down a bit of mortgage principal and added $13K to retirement values. So our end of year numbers are pretty nice: nearly $2.3M in assets, $1.1M of that in retirement accounts, the rest in real estate. $1.5M net worth. We started the year with $940K in retirement and $1.4M net worth, so at least our net worth increased a good amount despite the debt! We need $918K to be at Coast FIRE, so that means we have a $200K surplus in our retirement accounts. (And as a reminder, I don't factor Social Security benefits into our retirement assets at all.)

I'll try to write a wrapup of our 2025 finances and the year in general, but I'll probably wait til tomorrow when I officially close out the books on December.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 41,722 pounds |

$52,153 |

|

|

| AV2: 8,462 pounds |

$10,578 |

|

|

| NT's trad. rollover IRA |

$157,923 |

|

|

| NT's Roth IRA |

$105,403 |

|

|

| NT's SEP IRA |

$9,117 |

|

|

| NT's AAC acct |

$15,724 |

|

|

| AS's trad. rollover IRA |

$39,396 |

|

|

| AS's Roth IRA |

$149,583 |

|

|

| AS's SEP IRA |

$106,144 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$331,545 |

|

|

| CJ's Roth IRA |

$113,827 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,296,138 |

retirement only: |

$1,128,658 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$320,108 |

|

|

| Rental property mortgage |

$369,034 |

|

|

| HELOC |

$26,000 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$724,142 |

|

|

| |

|

|

|

| Current Estimated Net Worth December 2025 |

$1,571,996 |

|

|

| |

|

|

|

| November 2025 estimate: |

$1,582,873 |

|

|

| |

|

|

|

| Change in net worth |

-$10,877 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,128,658 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$210,473 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

3 Comments »

December 14th, 2025 at 06:40 pm

Well, I didn't do very well in the photo sharing challenge, but it was fun doing the few posts that I managed! It's been a crazy year; gonna try to remedy that in the new year, but who knows?

I'm very sad to report that one of our two cats, Whiskers (aka Whiskey), passed away last Tuesday. He had cancer that was diagnosed nearly a year before, plus a host of other medical conditions, so we're grateful to have gotten that amount of time with him. He was slowing down and we knew his health was failing, but we kept him around as long as he still seemed to be enjoying life. Even 24 hours before he went into distress, he climbed into my lap and snuggled comfortably, and gulped down his favorite treats after taking his pills that afternoon. But Tuesday morning he vomited, lost all strength, and was meowing at us in a different way than he ever had, so we took him to the ER. He had a number of things going on that we could've tried to address, but he'd clearly reached the point where he wouldn't be enjoying life anymore, so we made the decision to put him to sleep.

The only other living thing I've watched die was my mom almost exactly 3 years before. There were a lot of similiarites, and also this was much better than my mom's hard few days before she passed, so it brought up some other emotions that probably mixed in with the grief.

The house is very quiet, tidier, and a bit empty feeling. We're all still getting over it. He was a big character and super affectionate and naughty, and he required a fair bit of care during his final year, so our lives are pretty different now.

Posted in

Uncategorized

|

9 Comments »

December 1st, 2025 at 02:22 am

Wow, it's just wild to me that it's already the end of the year. I started working on my 2026 Annual Budget this weekend! I have to wait to see how a bunch of things shake out before I finalize it, but I did what I could at this point.

We had very small increases to our retirement and paid off about $1800 of debt principal, so we had a $6K increase to our net worth. Since it appears impossible that we'll pay off our HELOC by the end of the year, which was my deadline before I add it to our "official" debt on our net worth spreadsheet, I fully expect our net worth to decrease at the end of the year even if the markets go up.

But luckily we're over $190K ahead of where we need to be for CoastFIRE, so I'm not worried about it. Probably the worst case scenario is we'll still have $25K of debt in our HELOC, which is a bummer but won't make a huge dent in our Coast surplus. And I'm hoping when I tally things at the end of the year that I can pay it down a little so it'll be less debt than that.

EDIT: I forgot we received an annual update on one of NT's UK pensions, which increased by about US$6,000, so at least that means this month's net worth increase was double what I thought--just over $12K!

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 41,722 pounds |

$52,153 |

|

|

| AV2: 8,462 pounds |

$10,578 |

|

|

| NT's trad. rollover IRA |

$155,865 |

|

|

| NT's Roth IRA |

$104,028 |

|

|

| NT's SEP IRA |

$8,987 |

|

|

| NT's AAC acct |

$14,794 |

|

|

| AS's trad. rollover IRA |

$38,889 |

|

|

| AS's Roth IRA |

$147,449 |

|

|

| AS's SEP IRA |

$104,760 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$328,040 |

|

|

| CJ's Roth IRA |

$112,343 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,282,631 |

retirement only: |

$1,115,151 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$321,058 |

|

|

| Rental property mortgage |

$369,700 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$699,758 |

|

|

| |

|

|

|

| Current Estimated Net Worth November 2025 |

$1,582,873 |

|

|

| |

|

|

|

| October 2025 estimate: |

$1,570,793 |

|

|

| |

|

|

|

| Change in net worth |

$12,080 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,115,151 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$196,966 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

4 Comments »

October 31st, 2025 at 10:55 pm

I have to play catchup on photos again! Hopefully I'll find time tomorrow. Meanwhile here's our net worth update.

It was another pretty good month thanks mainly to retirement gains. I still expect the bubble to burst at some point, but we have a nearly $190K surplus on our CoastFIRE balance, so I'm not too worried. Also there's always a rebound after a downturn, and we've got at least another decade before we fully retire.

Next month our debt will go under $700K, which would be a cool milestone except it's looking much more certain that we will not even come close to paying off our HELOC this year, so whatever that balance is on 12/31 I'll be adding that to our "official" debt balance.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 8,462 pounds |

$10,578 |

|

|

| NT's trad. rollover IRA |

$155,219 |

|

|

| NT's Roth IRA |

$103,586 |

|

|

| NT's SEP IRA |

$8,950 |

|

|

| NT's AAC acct |

$14,314 |

|

|

| AS's trad. rollover IRA |

$38,724 |

|

|

| AS's Roth IRA |

$146,834 |

|

|

| AS's SEP IRA |

$104,315 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$326,634 |

|

|

| CJ's Roth IRA |

$111,865 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,272,161 |

retirement only: |

$1,104,681 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$322,004 |

|

|

| Rental property mortgage |

$370,364 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$701,368 |

|

|

| |

|

|

|

| Current Estimated Net Worth September 2025 |

$1,570,793 |

|

|

| |

|

|

|

| September 2025 estimate: |

$1,549,688 |

|

|

| |

|

|

|

| Change in net worth |

$21,105 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,104,681 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$186,496 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

1 Comments »

October 22nd, 2025 at 04:00 am

Once again I got super busy, this time going to DC (by way of Baltimore airport) and Northern Virginia (hence "DMV" which is a common abbreviation for the area--thank goodness I didn't spend 5 days in the Dept of Motor Vehicles!!). It was just the parents--the kids stayed home again (with their godfather in the lower part of the duplex, so not really "home alone").

We flew in Thursday and I didn't take many pics, but I did take one of a mezcal menu to text my friend who's a fan of the liquor to ask his advice on which flight to order, heheh. (He didn't answer so I picked at random.)

On Friday, we went to a fancy little awards gala for Black authors, where the main awards were called "the Zoras" (after Zora Neale Hurston). Afterward in the bar we ended up at a table with two of the winners, so I snapped a pic of their trophies!

On Saturday we had another fancy event in the evening associated with this same group, but first, during the day, NT and I attended the DC No Kings rally! It was massive, and very peaceful, and we got to hear Bernie Sanders speak (though we couldn't see him from where we were).

On Sunday, I went to Northern Va. where my dad lives. All three of my sisters plus some nieces and nephews came by for a few hours too. I didn't take many pics that don't have my relatives' faces in them, but I did snap one of my kid V's wallet, which they thought was gone forever but had actually been left at my sister's on their last visit a few months before. More than the wallet, they'd been super sad about the leather "chip" in it from their first YMCA camp, so I texted a pic right away!

I stayed at my dad's Sunday night and in the afternoon we had one more game of Scrabble before I headed to the airport. It was a close one til I got a big triple-word score near the end. With this win, I beat him 2 out of 3. (His final score is hard to read but it's 276.) But I had to work hard for those wins--he's 94 years old but his brain is sharp as a tack!

I didn't take any pics today but doing this post reminded me to, so here's a shot of my other kitty Clue! She's the same age as the sick old cat, but she's more independent and busy so she's not hanging around me trying to get a cuddle all the time.

Posted in

Uncategorized

|

3 Comments »

October 17th, 2025 at 09:12 pm

Hahaha, I drastically underestimated how hectic my October is; I've got so much going on and trying to get my paid work done in between other things has made for crazy days that are over before I know it. Well, I've got a couple hours of downtime right now, so I looked through my phone to see if I happened to take any pics this last week. Not many, but here are a few:

Saturday 10/11

I spent Friday-Sunday in a DIY in-town "writer's retreat" with a friend; we visited libraries, coffeeshops and other locations around Minneapolis and wrote intensively at each one. I got over 10K words written but didn't take many photos! However, after our full day of writing Saturday I caught a good music show in a charming dive bar, and I liked this pic from it:

Tuesday 10/14

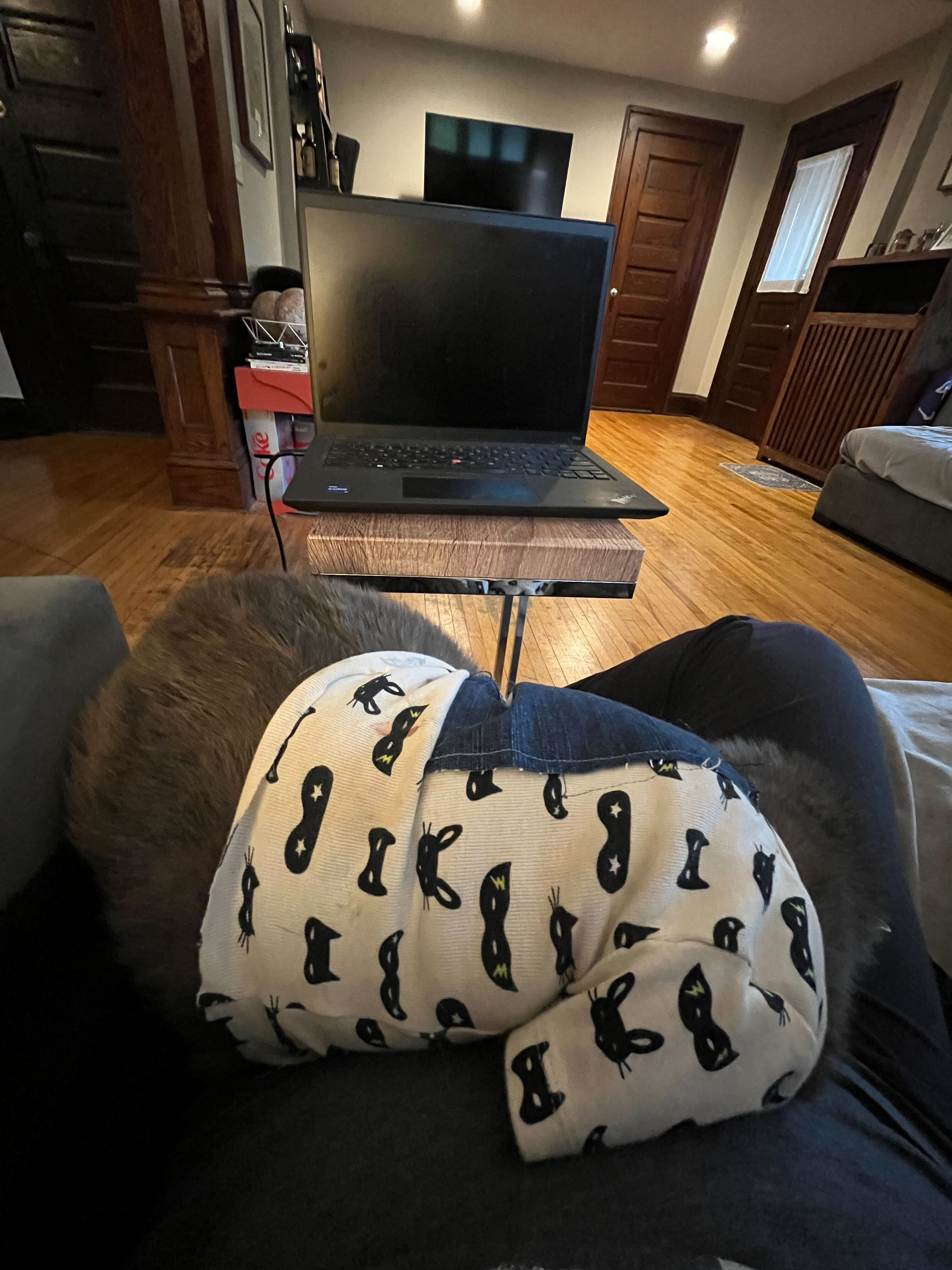

Our sick cat loves to sit on my lap when I'm trying to get work done because I work on the couch. Usually he cuddles down where the computer would go so AS got me this table that fits over him so I can keep working while he sleeps. But that day, he decided to sit in such a way that the table was rendered useless because it wouldn't fit over him. So I took a pic to send AS:

Thursday 10/16

I was in a bad mood and having trouble focusing so I took a walk around the neighborhood. The fresh air and exercise cleared my head and this Halloween display cheered me up by making me laugh:

Posted in

Uncategorized

|

6 Comments »

October 10th, 2025 at 12:40 am

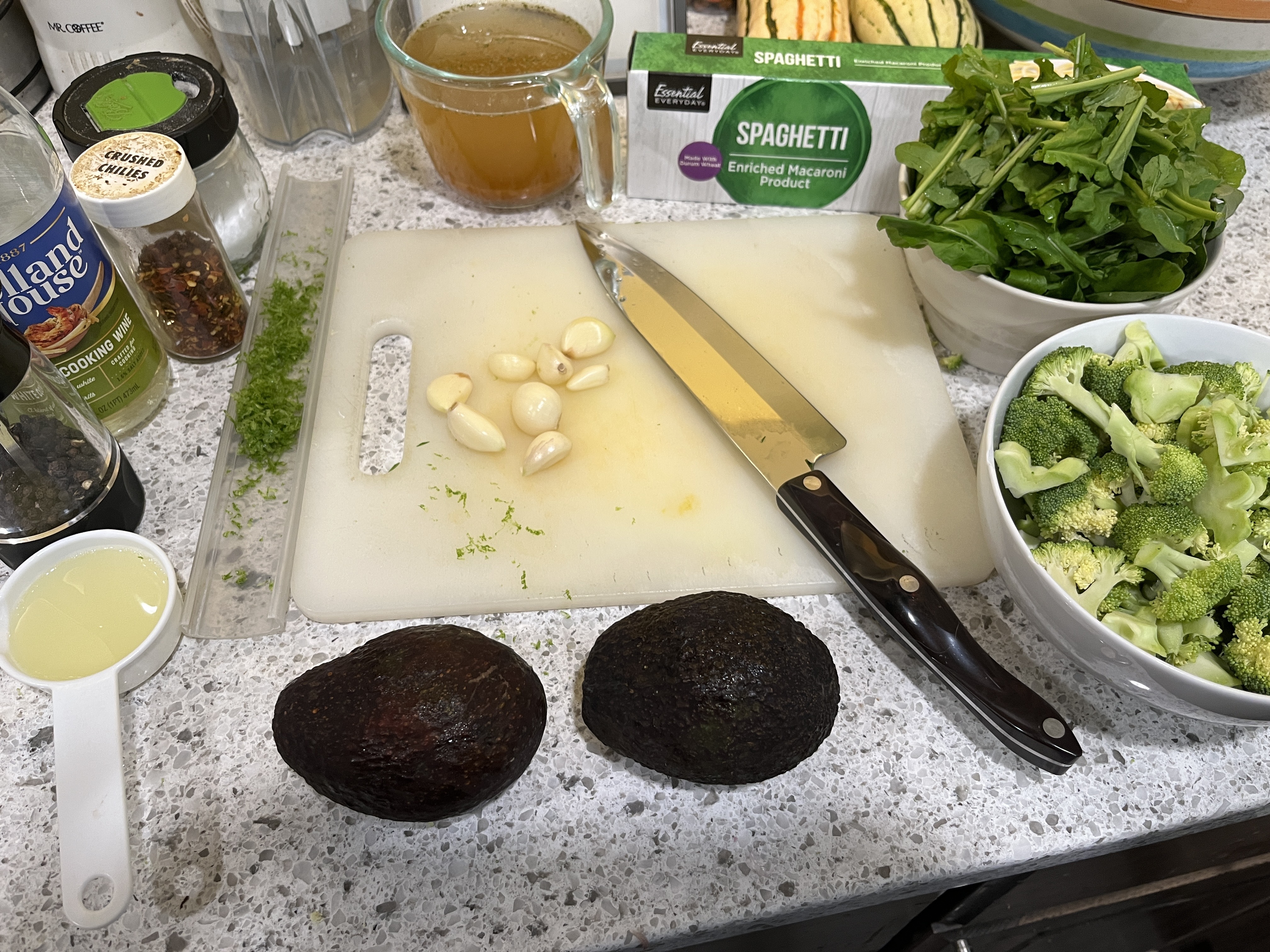

I remembered to take a photo while I was prepping dinner. Not very aesthetic or exciting but here tis! This is a recipe called Pasta Della California from the cookbook Veganomicon by Isa Chandra Moskowicz. I don't know when we started topping it with chopped up vegan chikn nuggets, but that was part of it (not pictured).

It contains lime juice and zest, garlic, chili flakes, salt, veggie broth, white wine, broccoli, arugula and avocado. Usually I do it with linguine but had to settle for spaghetti tonight.

Posted in

Uncategorized

|

2 Comments »

October 9th, 2025 at 05:25 am

I've been wanting to get more active on the blogs again for, like, years, but the things I need and love to do have just expanded and filled every nook and cranny of my life, it seems. So blogging at the level I used to just seemed daunting. This photo game feels like a low-stakes (in terms of time and mental effort) way to hang out with y'all more, so I'm going to try. If I happen to take a photo and if I happen to remember to post it, I shall.

This was the only pic I took today. Our kitchen's heated floor just got turned on after our unseasonably warm fall finally cooled off, and so immediately the critters started gravitating to it. This is my oldest kid (AA, 15) and one of our two old cats, Whiskers (Whiskey). He's the one with cancer; he's also got a benign tumor on his back (unrelated to the terminal cancer) that he'll scratch until it's gouged and bleeding, so we put him in baby shirts now. He can even do a lot of damage through T-shirt material, so AS sews denim patches over the tumor spot. Now he can scratch to his heart's content and not bloody up his back!

Posted in

Uncategorized

|

5 Comments »

September 30th, 2025 at 09:51 pm

We're back from Europe! We had a fantastic time in Portugal (new to us) and Spain (2nd time there). I was exhausted from an intense summer of work so I did more relaxing than sightseeing, but I didn't mind--relaxing away from all my stuff and responsibilities was way more impactful than if I'd tried to have a staycation or anything. Anyway, we all loved Portugal and it's definitely at the top of possible places we'd love to have a winter home, if we can figure out how to afford that. We've been having fun discussing different scenarios, trying not to get too stuck in one way of thinking but really explore all angles, even the out-there ones.

The retirement accounts did well this past month; our net worth went up $28K, largely due to stock market gains. The CoastFIRE calculator says I could keep coasting and retire at 61, so only 10 years away!

The travel spending this year way outstripped what we budgeted for, so we're currently running at a deficit for the year. I know there's more spending and also more income to go this year, so I'm not trying to predict how much we'll be in the hole, but I do think we'll be a certain amount so. I don't have the HELOC reflected in net worth because I was hoping to go in the opposite direction this year, especially when it seemed like NT was going to get a lucrative new job. That job is a much more remote possibility now, so at the end of the year, whatever we've accumulated in HELOC debt will make it onto the net worth spreadsheet. Right now it's at $24K; about half from 2024 and half from this year. But it could be less by the end of the year, so I'll wait and see.

While it's not great to be overspending by $1K a month, part of it is definitely me and AS still getting our business growing. I'm on track to make at least $15K more this year (gross) than last (of course our spending/expenses increased a similar amount this year so it's not solving all our problems lol) and I think there's room to grow, so we're on a good trajectory!

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 8,462 pounds |

$10,578 |

|

|

| NT's trad. rollover IRA |

$152,190 |

|

|

| NT's Roth IRA |

$101,583 |

|

|

| NT's SEP IRA |

$8,765 |

|

|

| NT's AAC acct |

$13,600 |

|

|

| AS's trad. rollover IRA |

$37,983 |

|

|

| AS's Roth IRA |

$143,809 |

|

|

| AS's SEP IRA |

$102,297 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$321,013 |

|

|

| CJ's Roth IRA |

$109,702 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,252,662 |

retirement only: |

$1,085,182 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$322,948 |

|

|

| Rental property mortgage |

$371,026 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$702,974 |

|

|

| |

|

|

|

| Current Estimated Net Worth September 2025 |

$1,549,688 |

|

|

| |

|

|

|

| August 2025 estimate: |

$1,521,670 |

|

|

| |

|

|

|

| Change in net worth |

$28,018 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,085,182 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$166,997 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

5 Comments »

September 10th, 2025 at 04:01 pm

I can finally access blogs and write entries, hooray! There was about a week when I couldn't, so I couldn't make my usual monthly net worth post.

It was pretty good news for August: about a $25K bump in net worth, mostly due to retirement fund values increasing. We're comfortably at CoastFIRE with a $140K surplus. I tried the calculator with different ages than my 65 goal, and it says I could theoretically retire at 62 and still be at CoastFIRE status. To retire at 61 (10 years from now) we would have to continue our current contributions ($250 per month) for 6 more years. To retire at 60 we would have to up our retirement contributions to $650 per month for the next 9 years (basically no CoastFIRE, just save til retirement).

Who knows what the future will bring, but it's kind of fun playing around with the numbers! We are currently on a European vacation that is definitely over our travel budget for this year, and we're facing spending overages in nearly every category this year, so it's good to feel like our retirement nest egg is healthy at least. I hope it doesn't crash too terribly in the coming months/years.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 7,971 pounds |

$9,964 |

|

|

| NT's trad. rollover IRA |

$148,165 |

|

|

| NT's Roth IRA |

$98,902 |

|

|

| NT's SEP IRA |

$8,521 |

|

|

| NT's AAC acct |

$12,838 |

|

|

| AS's trad. rollover IRA |

$36,989 |

|

|

| AS's Roth IRA |

$139,800 |

|

|

| AS's SEP IRA |

$99,598 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$313,519 |

|

|

| CJ's Roth IRA |

$106,807 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,226,245 |

retirement only: |

$1,058,765 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$323,890 |

|

|

| Rental property mortgage |

$371,685 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$704,575 |

|

|

| |

|

|

|

| Current Estimated Net Worth August 2025 |

$1,521,670 |

|

|

| |

|

|

|

| July 2025 estimate: |

$1,495,179 |

|

|

| |

|

|

|

| Change in net worth |

$26,491 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,058,765 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$140,580 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

3 Comments »

August 1st, 2025 at 05:58 pm

We had a very modest increase (about $10K) in net worth; $2K was mortgage reduction and the rest our retirement funds. We're still solidly in CoastFIRE status with a $100K+ surplus, which is good because our spending is outpacing our earnings so far this year. (Some of the extra spending is discretionary; we're taking a trip to Europe and a few others as well, and some of the home improvements we've made weren't strictly necessity. Other things like healthcare, escrow increase, taxes owed and supportive care for our cat with cancer were unavoidable unforeseen costs.) I'm leaning on our HELOC to keep our checking account in the green. I'm hoping to pay some or all of it down before the end of the year, so I haven't added it to the debt side of our net worth calculations, but if it's still lingering by the new year, I will.

Since we all have self-employment and side hustles in addition to the more predictable income of NT's job and the property rentals, that could still change, fingers crossed. But I'm glad we have this cushion in our CoastFIRE plan right now; it makes me less stressed about this year's deficit.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 7,971 pounds |

$9,964 |

|

|

| NT's trad. rollover IRA |

$144,294 |

|

|

| NT's Roth IRA |

$96,310 |

|

|

| NT's SEP IRA |

$8,286 |

|

|

| NT's AAC acct |

$12,014 |

|

|

| AS's trad. rollover IRA |

$36,033 |

|

|

| AS's Roth IRA |

$135,938 |

|

|

| AS's SEP IRA |

$96,987 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$306,375 |

|

|

| CJ's Roth IRA |

$104,007 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,201,350 |

retirement only: |

$1,033,870 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$324,829 |

|

|

| Rental property mortgage |

$372,342 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$706,171 |

|

|

| |

|

|

|

| Current Estimated Net Worth July 2025 |

$1,495,179 |

|

|

| |

|

|

|

| June 2025 estimate: |

$1,484,743 |

|

|

| |

|

|

|

| Change in net worth |

$10,436 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,033,870 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$115,685 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

1 Comments »

July 1st, 2025 at 05:16 pm

It definitely feels premature to be celebrating with so much current and potential chaos in our country, but we had a second good month in the markets, almost as much as last month, and hit an exciting milestone: over a million in our nest egg!

We're Coasting along with a $106K surplus to our CoastFIRE number. I tinkered with the calculator and it says we're at Coast even if I retired at 63 instead of 65. Aiming for 62, we'd be supposedly able to reach Coast in 3 years with just the tiny amount NT is putting in his 401(k).

This is all good to see, because we just booked a European vacation for this fall that we can only partly pay for, so we're going to be carrying a bit of it as debt for a while. So that felt like a reckless decision (though I did contemplate it for months, it wasn't exactly impulsive) and I'm glad to see proof of my more sensible side as well.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 7,971 pounds |

$9,964 |

|

|

| NT's trad. rollover IRA |

$143,161 |

|

|

| NT's Roth IRA |

$95,544 |

|

|

| NT's SEP IRA |

$8,214 |

|

|

| NT's AAC acct |

$11,440 |

|

|

| AS's trad. rollover IRA |

$34,387 |

|

|

| AS's Roth IRA |

$134,758 |

|

|

| AS's SEP IRA |

$96,215 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$304,501 |

|

|

| CJ's Roth IRA |

$103,180 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,192,506 |

retirement only: |

$1,025,026 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$325,765 |

|

|

| Rental property mortgage |

$372,998 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$707,763 |

|

|

| |

|

|

|

| Current Estimated Net Worth June 2025 |

$1,484,743 |

|

|

| |

|

|

|

| May 2025 estimate: |

$1,448,816 |

|

|

| |

|

|

|

| Change in net worth |

$35,927 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$1,025,026 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$106,841 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

(A note about the "loan from friends" item, which I explained in comments a while back but is worth mentioning for anyone who's confused... we had a very informal agreement with our friends (who rent the bottom half of the duplex) that we would let them gradually obtain part ownership of the duplex. They helped out in the early days of ownership with a bit of money for the down payment and for some urgent repairs, and we were going to put that toward their portion of the house. For various reasons, that plan sort of stalled over the years, so I consider that money they gave us to be a loan. I'm not sure they even do, or if we're still planning on revisiting that co-ownership idea, so I just kind of let it hang out there as a "loan" in case it ever comes up. I would pay them back if we definitively decided we weren't doing the ownership thing.

One reason I'm in no hurry to settle this one way or the other is we do each other lots of favors. Their rent is basically 2/5ths of the mortgage payment and 2/7ths of the utilities, so it's WAY under the going rate for a 2-bedroom in our neighborhood. But then again, they pretty much gave us their old car (it's in their name but we have primary use of it). We've been friends for decades so there's a lot of gray area in our arrangement. Like I said, they might not even consider that money to be a loan so much as a gift, but to me it could go either way so I keep it classified as a loan.

Posted in

Tracking Net Worth

|

4 Comments »

May 31st, 2025 at 07:40 pm

Finally a decent month for retirement growth. We're at Coast FIRE with a surplus of $72K; the calculator says I could plan to retire at 64 instead of 65 and still be Coast!

It really really burns me that while I'm riding the waves of market volatility, all sorts of speculators with inside info are getting even richer by figuring out when some stupid Trump move is gonna make the market crash and rise again. But whatever. Just gonna keep on keeping on.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 7,971 pounds |

$9,964 |

|

|

| NT's trad. rollover IRA |

$137,592 |

|

|

| NT's Roth IRA |

$91,861 |

|

|

| NT's SEP IRA |

$7,876 |

|

|

| NT's AAC acct |

$10,331 |

|

|

| AS's trad. rollover IRA |

$34,387 |

|

|

| AS's Roth IRA |

$129,224 |

|

|

| AS's SEP IRA |

$92,507 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$294,079 |

|

|

| CJ's Roth IRA |

$99,202 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,158,165 |

retirement only: |

$990,685 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$326,698 |

|

|

| Rental property mortgage |

$373,651 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$709,349 |

|

|

| |

|

|

|

| Current Estimated Net Worth May 2025 |

$1,448,816 |

|

|

| |

|

|

|

| March 2025 estimate: |

$1,409,271 |

|

|

| |

|

|

|

| Change in net worth |

$39,545 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$990,685 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$72,500 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

5 Comments »

May 1st, 2025 at 12:30 am

Our net worth went up about $13K. We regained a little over half what we lost last month in net worth, aided by some modest gains in NT's UK pension that we hadn't recorded for a couple years, plus our minimum paydown on mortgages, plus a small 401k contribution, plus a partial recovery on our retirement fund values.

We're still below where we were in November 2024, and well below our January 2025 high, so it's not exactly exciting, but at least it's not ruinous. We remain in Coast FIRE territory with a $34K surplus.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 29,509 pounds |

$36,886 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 7,971 pounds |

$9,964 |

|

|

| NT's trad. rollover IRA |

$131,526 |

|

|

| NT's Roth IRA |

$87,825 |

|

|

| NT's SEP IRA |

$7,499 |

|

|

| NT's AAC acct |

$9,490 |

|

|

| AS's trad. rollover IRA |

$32,904 |

|

|

| AS's Roth IRA |

$123,026 |

|

|

| AS's SEP IRA |

$88,442 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$283,540 |

|

|

| CJ's Roth IRA |

$94,844 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,120,202 |

retirement only: |

$952,722 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$327,629 |

|

|

| Rental property mortgage |

$374,302 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$710,931 |

|

|

| |

|

|

|

| Current Estimated Net Worth April 2025 |

$1,409,271 |

|

|

| |

|

|

|

| March 2025 estimate: |

$1,395,770 |

|

|

| |

|

|

|

| Change in net worth |

$13,502 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$952,722 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$34,537 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

3 Comments »

April 1st, 2025 at 04:02 am

We lost about $24K of retirement savings, or about 2.5% of the total value of those funds. Offset by a small contribution to NT's 401k and our regular mortgage payments, our net worth decreased by $22K.

I turned 51 this month, so our CoastFIRE number increased $35K. We are still at CoastFIRE with a $22,500 surplus of where we need to be at. A far cry from the $86K surplus I had in January, but what can you do? It's all worth it to have hundreds of thousands of government employees laid off, international students snatched off our local campuses by ICE, measles spreading like wildfire, our local foodbank losing 15% of its funding, planes falling out of the sky, Palestine and Ukraine being destroyed faster than ever, state supreme court races being bought by a billionaire, and the two-term limit about to be ignored. I mean there are too many blessings to list all in one place. Oh and a tech-bro kid named Big Balls has my social security number, yay!

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 26,511 pounds |

$33,139 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 7,971 pounds |

$9,964 |

|

|

| NT's trad. rollover IRA |

$130,331 |

|

|

| NT's Roth IRA |

$87,059 |

|

|

| NT's SEP IRA |

$7,430 |

|

|

| NT's AAC acct |

$8,944 |

|

|

| AS's trad. rollover IRA |

$32,608 |

|

|

| AS's Roth IRA |

$121,895 |

|

|

| AS's SEP IRA |

$87,671 |

|

|

| AS's Nevada acct (approx amt) |

$380 |

|

|

| CJ's trad. rollover IRA |

$280,963 |

|

|

| CJ's Roth IRA |

$94,017 |

|

|

| CJ/NT/AS house ($643,000 value -6%) |

$604,420 |

|

|

| CJ/NT/AS rental property ($599,000 value -6%) |

$563,060 |

|

|

| TOTAL ASSETS |

$2,108,277 |

retirement only: |

$940,797 |

| |

|

|

|

| Debt |

|

|

|

| Main mortgage |

$328,557 |

|

|

| Rental property mortgage |

$374,950 |

|

|

| Loan from friends (main house) |

$9,000 |

|

|

| TOTAL DEBT |

$712,507 |

|

|

| |

|

|

|

| Current Estimated Net Worth March 2025 |

$1,395,770 |

|

|

| |

|

|

|

| February 2025 estimate: |

$1,417,956 |

|

|

| |

|

|

|

| Change in net worth |

-$22,186 |

|

|

| |

|

|

|

| |

|

|

|

| COAST FIRE: |

https://walletburst.com/tools/coast-fire-calc/ |

|

|

| retirement goal |

$1.59 million by 2039 (CJ age 65) |

|

|

| |

|

|

|

| Current age: 51 |

|

|

|

| Retirement age: 65 |

|

|

|

| Annual spending in retirement: $63,600 |

|

|

|

| Monthly contribution: $250 |

|

|

|

| Investment growth rate: 7% |

|

|

|

| Inflation rate: 3% |

|

|

|

| Withdrawal rate: 4% |

|

|

|

| Current invested assets |

$940,797 |

|

|

| Coast FIRE number at current age |

$918,185 |

|

|

| Current status: at Coast FIRE with surplus: |

$22,612 |

|

|

| |

|

|

|

| |

|

|

|

| Coast FIRE budget |

|

|

|

| Ideal budget |

Monthly |

|

|

| Housing |

$0 |

(rent will cover prop expenses) |

|

| Healthcare |

$1,500 |

|

|

| Groceries |

$1,000 |

|

|

| Fun |

$1,500 |

|

|

| Travel |

$1,000 |

|

|

| Utilities |

$500 |

|

|

| Giving |

$500 |

|

|

| Home improvement |

$500 |

|

|

| Gifts |

$250 |

|

|

| Transportation |

$250 |

|

|

| Monthly |

$7,000 |

|

|

| Minus add'l rental income |

-$1,700 |

|

|

| Total monthly |

$5,300 |

|

|

| Annual |

$63,600 |

|

|

| |

|

|

|

| SSN estimates 2024 |

Start age 62 |

Start age 70 |

|

| Monthly benefit |

$4,200 |

$7,200 |

|

| Plus monthly from retirement |

$5,300 |

$5,300 |

|

| Total monthly |

$9,500 |

$12,500 |

|

Posted in

Tracking Net Worth

|

3 Comments »

March 1st, 2025 at 06:02 pm

Well, despite Musk and Trump's best efforts to capsize the economy, we only lost $2700 of net worth. It would've been closer to $4K but our regular mortage principal payments and NT's small contribution to his 401(k) offset it a bit.

Tomorrow I turn 51, so my next CoastFIRE calculation will be at that age, but for now, we're on track with Coasting with an $82K surplus of where we need to be.

No other financial news, really. NT still waiting to see if his high-paying dream job comes to fruition, but it hasn't been ruled out, just supposedly taking longer to get things in place than expected. So he's very optimistic and I'm still cautiously willing to entertain the scenario but not counting on anything.

| Assets |

|

|

|

| NT's UK pensions: |

|

|

|

| AV1: 26,511 pounds |

$33,139 |

|

|

| SW: 37,117 pounds |

$46,396 |

|

|

| AV2: 7,971 pounds |

$9,964 |

|

|

| NT's trad. rollover IRA |

$134,245 |

|

|

| NT's Roth IRA |

$89,681 |

|

|

| NT's SEP IRA |

$7,670 |

|

|

| NT's AAC acct |

$8,649 |

|

|

| AS's trad. rollover IRA |

$33,571 |

|

|

| AS's Roth IRA |

$125,830 |

|

|