|

|

|

June 30th, 2021 at 03:43 am

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 27,225 pounds ($34,031)

FL: 6,462 pounds ($8,078)

NT's trad. rollover IRA: $111,934

NT's Roth IRA: $66,268

NT's SEP/SIMPLE: $2,500

AS's trad. rollover IRA: $28,143

AS's Roth IRA: $95,092

AS's SEP IRA: $72,046

CJ's 401(k): $228,862

CJ's Roth IRA: $72,251

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $592,200 ($630,000 value -6%)

---

TOTAL ASSETS: $1,551,901

Debt:

US Mortgage $367,740

Loan from friends (duplex) $9,000

UK Mortgage 1 $25,813

UK Mortgage 2 $5,441

UK Mortgage 3 $5,730

---

TOTAL DEBT $413,724

Current Estimated Net Worth: $1,138,177

May 2021 estimate: $1,122,570

Change in net worth: +$15,607

Summary: I actually remembered to do net worth two months in a row, and it was a pretty good month!

Notes on the numbers above: House value estimates are usually approximate. UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound (just to have a system, even though I checked the exchange rate and it's more like 1 to $1.38).

Posted in

Tracking Net Worth

|

0 Comments »

May 29th, 2021 at 09:24 pm

I started trying a retirement calculator, realized I needed our current investment numbers which I hadn't run in a few months, and decided to do a full net worth update while I was at it...

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 27,225 pounds ($34,031)

FL: 6,462 pounds ($8,078)

NT's trad. IRA: $110,382

NT's Roth IRA: $64,842

AS's trad. IRA: $27,759

AS's Roth IRA: $93,245

AS's SEP IRA: $71,038

CJ's 401(k): $224,575

CJ's Roth IRA: $70,741

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $592,200 ($630,000 value -6%)

---

TOTAL ASSETS: $1,537,387

Debt:

US Mortgage $368,556

Loan from friends (duplex) $9,000

UK Mortgage 1 $26,005

UK Mortgage 2 $5,483

UK Mortgage 3 $5,773

---

TOTAL DEBT $414,817

Current Estimated Net Worth: $1,122,570

January 2021 estimate: $1,039,463

Change in net worth: +$83,107

Summary: It's kind of fun skipping a few months of calculations; much more dramatic drops in debt and increases in net worth! We averaged about $20K of gains in net worth per month since January.

Notes on the numbers above: House value estimates are usually approximate. UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound.

Posted in

Uncategorized

|

0 Comments »

May 29th, 2021 at 08:55 pm

Had to change the retirement goal due to a raise I got last month! Old goal was $814,292 by March 2024.

New goal: $820,892 by March 2024

Current retirement balance: $732,687

November 2020 balance: $632,504

Progress since last update: $100,183

Still needed: $88,205

This interim goal is based on getting my and NT's retirement to 4x my current and his last full-time salary (currently $84,150 and $64,118) by the time we turn 50 and AS's retirement values to 3x her highest annual income ($75,940 in 2018) by the time she turns 45.

$84,150 x 4 = $336,600

$64,118 x 4 = $256,472

$75,940 x 3 = $227,820

It will shift anytime our salary/annual income changes. (The only exception is I won't lower if there's a lower-income year.)

There are 34 months to go before March 2024, so that means we need to gain $2594 per month on average to meet our goal. (Seeing as how we contribute a minimum of $2K per month and average out to more than $2700, that shouldn't be a problem!)

The ultimate goal we're working toward is 8x our annual income by the time we retire at 65.

Posted in

Uncategorized

|

0 Comments »

May 29th, 2021 at 08:54 pm

I usually get confused and overwhelmed when I try using retirement calculators. That's why I use the 8x rule of thumb as my goalposts for our retirement. But Firefly's post about Coast FIRE made me curious to try that calculator. (https://walletburst.com/tools/coast-fire-calc/)

I ran the numbers once, and it said at our current pace we'd reach Coast FIRE in 11 years! That would be incredible!

But then I realized what they meant by "net worth" was total invested. My net worth calculations count the value of our home, so I had to redo it. But, I also realized that initially I had $1500 listed for housing because even after we pay off the mortgage we'll have property taxes and insurance. I forgot that we do intend to still have rental properties, so the money from those should at least offset our housing expenses. Also, I estimated we put aside $2,500 but realized it's closer to $2,700 (conservatively). So I lowered my "net worth," raised retirement contributions, removed the line for housing expenses and tried again.

Here's my attempt at a retirement budget. (Let me know if you see any glaring omissions here.) Keep in mind this is for three adults.

| Ideal budget |

Monthly |

| Housing |

$0 |

| Healthcare |

$1,500 |

| Groceries |

$1,000 |

| Fun |

$1,500 |

| Travel |

$1,000 |

| Utilities |

$500 |

| Giving |

$500 |

| Home improvement |

$500 |

| Gifts |

$250 |

| Transportation |

$250 |

| Total monthly |

$7,000 |

| |

|

| Annual |

$84,000 |

I'm in between my spouses' age, so I used my age but our combined retirement investments.

Current age: 47

Retirement age: 65

Annual spending in retirement: $84,000

Current net worth (retirement balance): $732,687

Monthly contribution: $2,700 (varies, but this is a conservative approximate average)

Investment growth rate: 7%

Inflation rate: 3%

Withdrawal rate: 4%

Coast FIRE number at current age: $1,036,619

Result: You're 12 years from Coast FIRE!

Unbelievable. I only seem to have added one year in my new calculation. Is this telling me at this rate I'll be done saving for retirement by 59 and be able to retire at 65? If so that's amazing, because if you'd asked me when I'd have enough saved I'd've said "never." I'm sure I'm doing something wrong in the above calculations. Can you poke holes in this scenario?

Posted in

Uncategorized

|

4 Comments »

April 2nd, 2021 at 05:37 pm

I have a lot of stuff I want to get done today, but I also really wanted to check in since I realized it's been a couple months! Time both flies and crawls in the pandemic. It's the strangest thing.

Well first off the household except the kids is partially vaccinated! Our downstairs neighbors both got theirs, and when MN opened eligibility on 3/30 I started hunting. It took several hours but I decided to target my search at counties that had vaccinated at least 50% of their population, and I found a place 2.5 hours away that had appointments the next day. So on 3/31 I took a half day from work and NT and I drove 2.5 hours, got the shots, drove 2.5 hours back. We have the Moderna so we'll have to go back in 4 weeks unless we can find a second shot closer to home. By 4/14 the first dose's preventive benefits will be in play and on 4/28 we become eligible for a second shot, so hopefully by 5/14 we will be well protected.

By coincidence, AS was in the Johnson + Johnson trial and she went the same day to find out whether she'd gotten the real vaccine. Turns out she'd had the placebo, so they gave her the shot then. She had a horrible reaction, vomiting and other tummy troubles plus chills and hot flashes, but is feeling much better today. At least her shot was one and done! So she should be well protected by 4/14.

I've been really busy on my music website that I mentioned in my previous post, adventuresinamericana.com. We have a small audience but feels like it's building slowly but steadily. I have more musicians reaching out asking to be interviewed and I keep finding new albums and new artists, so there's no shortage of content. I could probably write more than one post a week and still have plenty of topics, but I feel like it's already taking time away from other stuff, so I don't want to go there just yet, as fun as it is.

I haven't spent as much time on my other hobbies--writing fiction, self-publishing it, songwriting and guitar playing--but I give them a bit of time every week at least. I wrote a new song about a month or two ago and am slowly revising a third novel to eventually self-publish.

I started a weight loss journey in January to take off the pandemic gain (about 10 lbs.), and it was going well until the insurrection. My weight went back up and I haven't made any progress since then. I lose a few and then gain them back, over and over. Just having trouble getting enough walking in my work-from-home routine mainly, I think.

We are still talking with our contractor about the kitchen and things are plodding along at a slow and erratic pace. We got AC installed but that was handled through a different company. The city has approved our kitchen plan, and we've picked out our new window type and cabinet finish, but we need to pick flooring, countertops and backsplash, and we're waiting on something else as well from our contractor (can't remember what). We still need to choose appliances as well but we did decide we're going with stainless steel this time. We didn't want to do that when the kids were younger but they're a bit less likely to mess it up as much now that they're 9 and 11! But I still have no idea of the timeline, start date or overall cost of the renovation yet. The big picture cost estimate a couple years ago (yeah, this has been going on that long!) was $60K-$80K but I have no idea how that's changed as time has gone by and our plans have gotten more specific. We have about $35K saved up (plus a $10K emergency fund and we add about $1000 per month to reno savings) and I applied for a $50K HELOC, so hopefully we will be fine.

The kids have been back in school since mid-February and even with social distancing/masking requirements and some upheaval of being shuffled around as teachers and other families adjust plans, they're so much happier and better-adjusted. There's only been one COVID scare there and it was this week; I took the potentially exposed kid for a test and it came back negative in less than 24 hours. (It was doubtful whether she was actually exposed but we didn't want to take any chances.)

Music shows are starting to be scheduled, mainly outdoors, limited-ticket and socially distanced. I'm so happy to have tickets to several concerts--I've missed that more than almost anything!

Spring break has begun for the kids, so we're heading to a rental home for a week starting tomorrow. We were going to road trip to a new state (Iowa maybe) but with cases rising, MN doesn't want people traveling out of state so we got a place in southern MN. We're driving there with a rental car and don't plan to interact with anyone indoors outside of gas, groceries and takeout food. We'll continue the cautious behavior that has worked for us so far at home. We just wanted a change of scenery!

My job is still going, somehow; I'm not nearly as busy as before the pandemic but there seems to be enough work to keep me for a while longer at least. I've adjusted to remote work and hope to reap the benefits of being able to work from anywhere once the world opens back up. NT doesn't have a full time job but he's been working part time to stretch his unemployment benefits and that's going well. AS is making good self-employed income. Both of them are eyeing full time jobs; NT a remote position with a company that's very similar to the one that laid him off but supposedly with better work life balance (no international tasks that require him to be awake at all sorts of weird times). AS is going to apply for a high-level publishing job that would be a step up from any title she's held before but that she's well qualified for. So we'll see about both of those. If they don't pan out, I do think our current employment is serving us well. Once unemployment runs out, NT would just need to find a bit more part time work to keep us at the current level. That seems doable. I think he could pick up virtual admin assistant work quite easily because he excels at that. Plus, we might get that child tax credit monthly thing if that happens, which will also help.

What else? Pets, family and friends are doing well. Our only loss during the pandemic has been our good friend's dog (who we loved), and that was of old age.

Our tax guy is backed up (and we didn't send our packets until early March) so we have no idea what taxes will look like this year. We have a bunch of money set aside and hopefully that will cover it.

I haven't checked our net worth or retirement accounts in a while. It's all just kind of on autopilot; I make quarterly contributions to AS's SEP, I'm setting aside money from NT's income to eventually open maybe a SIMPLE for him, I'm still doing the 401(k) through my work (though no matching benefits anymore), and we're on track to max out Roths.

I guess that's it! Sorry I haven't been posting as much but I do keep up on everyone's blogs pretty regularly.

Posted in

Uncategorized

|

1 Comments »

February 1st, 2021 at 10:20 pm

While I'm still working on self-publishing novels, my next work in progress is a bit stalled while I wait for reader feedback so that I can edit it. Meanwhile, a friend and I restarted a project we'd been discussing just before the pandemic hit.

We both really love music; she loves all kinds while I'm mainly interested in Americana -- country, folk, bluegrass and such. I love to write about music and my friend loves designing websites, so together we created a site called Adventures in Americana! It's mainly to provide positive publicity for musicians via record reviews, interviews and an events calendar.

If you love this kind of music, or just want to see what I'm up to, check it out at www.adventuresinamericana.com !

Budgetwise, this is a hobby that's not expected to make any money, so it comes out of my personal spending. So far I've paid $20 for a year of the domain name and $126 for a year of web hosting. We'll be doing an e-newsletter that I'll have to pay extra to do through Squarespace, but we get three free emails so I haven't had to pay anything for that yet.

Anyway, less than $20 per month to pursue this creative project is definitely worth it to me! I've written a few more articles and have a bunch of ideas for more, so we'll be posting something new every week, at least for a while.

Posted in

Uncategorized

|

5 Comments »

February 1st, 2021 at 12:09 am

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 27,225 pounds ($34,031)

FL: 6,462 pounds ($8,078)

NT's trad. IRA: $100,547

NT's Roth IRA: $56,914

AS's trad. IRA: $25,336

AS's Roth IRA: $82,582

AS's SEP IRA: $61,625

CJ's 401(k): $199,238

CJ's Roth IRA: $62,265

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $592,200 ($630,000 value -6%)

---

TOTAL ASSETS: $1,463,312

Debt:

US Mortgage $371,796

Loan from friends (duplex) $9,000

UK Mortgage 1 $26,779

UK Mortgage 2 $5,645

UK Mortgage 3 $5,944

---

TOTAL DEBT $419,164

Current Estimated Net Worth: $1,044,148

December 2020 estimate: $1,039,463

Change in net worth: +$4,685

Summary: The markets did us no favors, but we made enough retirement contributions and paid off enough debt to show a modest gain this month.

Notes on the numbers above: House value estimates are usually approximate. UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound.

Posted in

Tracking Net Worth

|

1 Comments »

January 6th, 2021 at 03:11 pm

Does anyone know how I can change my password? I got a weird spammy email from someone claiming to be from Wordpress saying my SavingAdvice blog password had been changed; it hadn't, but made me want to update mine anyway since it's been a while. I can't for the life of me figure out where to do that! I went over to Forums but was unable to post a question and got logged out of the blog section, which in itself was a challenge to figure out how to get back into.

Posted in

Uncategorized

|

6 Comments »

January 5th, 2021 at 04:52 pm

We have three adults and two kids so we got $3,000. Our January budget is looking pretty good so I flowed $1,400 into our February budget and doled out the rest as personal money -- $400 for each adult and $200 for each kid.

The kids' money is split up: $120 each into savings, $20 each for giving, and $60 each to spend as they want.

The adults just get theirs as spending money. Well, for me and NT it mainly goes toward our personal money deficits -- mine from self-publishing and his from his hat business.

At least his hat business is pulling in some money and he may break even on his personal deficit soon -- my self-publishing is nowhere near profitable. That's my fault though, since I don't put a lot of work into publicizing my books. Turns out I like writing them, editing them and getting them into book form, but then I lose interest and want to work on the next book instead of marketing the ones I have out! Oh well.

Posted in

Uncategorized

|

1 Comments »

January 3rd, 2021 at 11:01 pm

I thought I'd share my budget for the year. It's an annual budget so each month is a little different; for instance, in February (the month shown below) I'm setting aside $800 for our summer CSA share. But this shows what our fixed or predictable income is, the necessities we need to cover first, and then the variables, listed in order of priority so we fund the more important ones first and go down the list. So far, we are fully funded for January and everything but groceries is funded in the needs list for February. Once we finish funding the essential expenses, subsequent income will go to funding variables. We still have some variable expenses outside of that list, so when they come up, I'll fund them with incoming freelance money if possible, or we'll discuss taking something out of one of the other categories if we need to.

I feed this month by month into our ongoing budgeting tool which I call "Number Crunch" or "future checkbook."

| |

Fixed income |

$1,967.30 |

| 2/14/2021 |

CJ paycheck |

$208.33 |

| $208.33 |

| 2/7/2021 |

Lower unit rental |

$5,353.26 |

| |

Essential expenses |

-$2,953.18 |

| 2/3/2021 |

AS healthcare |

-$41.75 |

| 2/3/2021 |

Roth IRAs |

-$210.00 |

| 2/17/2021 |

Xcel |

-$180.00 |

| 2/28/2021 |

Cell phones |

-$200.00 |

| 2/14/2021 |

Groceries |

-$200.00 |

| 2/28/2021 |

Groceries |

-$6,396.19 |

| |

|

-$1,042.93 |

| |

|

|

| 2/7/2021 |

Spending money |

-$198.00 |

| 2/21/2021 |

Spending money |

-$198.00 |

| |

Healthcare expenses |

-$50.00 |

| |

1/2 guitar |

-$800.00 |

| |

Kids' college |

-$500.00 |

| |

Vacays/travel |

-$250.00 |

| |

Giving |

-$4,152.00 |

| |

|

-$5,194.93 |

| |

Needed from NT/AS (gross pay -tax & retirement) |

$8,245.92 |

Posted in

Uncategorized

|

4 Comments »

January 2nd, 2021 at 07:16 am

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 27,225 pounds ($34,031)

FL: 6,462 pounds ($8,078)

NT's trad. IRA: $100,851

NT's Roth IRA: $56,572

AS's trad. IRA: $25,413

AS's Roth IRA: $82,315

AS's SEP IRA: $59,256

CJ's 401(k): $198,555

CJ's Roth IRA: $61,939

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $592,200 ($630,000 value -6%)

---

TOTAL ASSETS: $1,459,706

Debts:

US Mortgage $372,600

Loan from friends (duplex) $9,000

UK Mortgage 1 $26,970

UK Mortgage 2 $5,685

UK Mortgage 3 $5,988

---

TOTAL DEBT $420,243

Current Estimated Net Worth: $1,039,463

November 2020 estimate: $1,015,882

Change in net worth: +$23,581

Summary: The gains continued for another month and my household closed out 2020 with net worth millionaire status!

Notes on the numbers above: House value estimates are usually approximate. UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound.

Posted in

Tracking Net Worth

|

3 Comments »

December 27th, 2020 at 10:16 pm

Happy holidays, whichever and however you celebrate! I've had a quiet and lazy time so far; I worked Monday and had the rest of the week off, and then I work part of tomorrow and have the whole rest of that week off. And I got pretty caught up on work so I can actually relax!

I'm eating and drinking a little too much and not getting much exercise, but I plan to get a little bit back into healthy habits next week and then really try to get back to normal after Jan. 1. I've been maintaining my shape this whole pandemic but starting around Thanksgiving it's gotten kind of rocky and I can see the difference in the mirror, even though I haven't been weighing myself since the lockdown started. So I really want to get active, cut out the snacks and cut down the drinking. But I've been so good all year considering the circumstances, that I'm letting myself slide a little bit longer.

I'm also being a little more lax about my creative goals this month. I wrote another song and another novel in November and I've got an older manuscript out with some beta readers, and I'm co-writing a novel with an old college friend. I have another couple I could be working on revising as well. But other than writing my chapters when it's my turn on the friend one, I haven't been doing much in December. I've been more or less keeping up on guitar practice/lessons at least.

Our new budget goes into effect 1/1, and so far we're only $1000 away from fully funding the January budget--all essentials are funded so it's just a couple of variables left. Once we do I'll start putting money toward the February budget, essentials first and working my way down the list. We need a bit over $8K (gross; that's just over $5K after tax/retirement) to fully fund February. AS has about $17K coming to her from projects that are mostly already done, so I'm not worried about hitting January and February and maybe even part of March, and by then she and NT will have some more money lined up hopefully.

NT's severance ran out so he's getting unemployment, not the maximum amount as he's been able to work a little doing admin work for our downstairs neighbors. He's also been able to help AS with her business so she was able to take a couple of extra proofreading jobs for him to do. So he is bringing in a little money from various sources and that'll help us fund our 2021 budget too.

The kids are on break and will be starting school fully from home in January; we're not sending them to the Y three days a week like we did the first semester. Partly because we were disturbed by skyrocketing cases here (though our numbers have decreased quite a bit over the past month) but also because with NT working part time, he's able to take care of the kids during the school day. And they've gotten very self-sufficient as they've become acclimated to distance learning. They're not doing perfectly at school, but good enough for me.

Our governor has said schools can start going back in person in mid-January if they meet certain conditions, but he's leaving the decision up to the individual districts. Our district has said they'll let us know over the break, so they still have another week before they need to announce their plans. I'm hoping for in-person, especially if our teachers can get vaccinated, but I trust them to be cautious and do what they think is best. Overall I've been satisfied and even impressed with how our school administrators and teachers have adapted. (Bad news for our kids though: now that everyone is set up for remote learning, there's going to be no such thing as snow days anymore, even if they do start going back in person!)

What else? Just waiting for a vaccine (I'm about the last person on the list so it'll be a while) and hoping things get normalish at some point next year. Now that I'm a full-time remote worker, and NT and AS too, it could get really interesting to possibly extend trips by working part of the time in another place. So I'm eager for travel and tourism to become a more feasible option again.

AS took part in a vaccine trial (for the Johnson & Johnson one that's still being tested) so she possibly already got the vaccine, but she won't be sure for a while. The rest of us are in the last groups that will get it--non-frontline workers, no health factors, middle-aged and under 16. But I'm excited for the rollout and really hope this helps us get to a place where we can be with other people again!

Posted in

Uncategorized

|

4 Comments »

December 9th, 2020 at 01:49 am

I'm gradually retiring my previous budgeting system and gearing up for a new one that will hopefully be flexible for our new income situation yet still enable us to maintain control, so I wanted to share it with you.

I'm excited and hopeful but also nervous because we've done things the same way for several years. It worked when we had two fixed incomes and one variable, but it won't work for one fixed and two variable. And there are other unknowns in our future as well, so I'm hoping this flexible format will work even if our income situation fluctuates over the course of the year.

So for the past few years, we've used two main tools for day-to-day budgeting: the Number Crunch (which I also call Future Checkbook) and the Weekly Spending Tracker. And big picture budgeting is mainly handled in my Annual Budget spreadsheet. Number Crunch starts with our checking account balance, lists out all the upcoming expenses and incomes for the next couple months, and ends with a balance of zero. I update the checking account balance and delete things that have already happened, so it always only shows things that are in the future.

I would factor in the predictable income and expenses based on the Annual Budget, which broke things out by month as well as having a 12-month snapshot tab. Every month or so I'd paste another month's worth of projections so that the Number Crunch was always looking ahead at least a month.

For the variable income (AS's freelance business), I usually put some of it in savings, set some aside for tax and retirement, and dumped the rest into the Weekly Spending Tracker sheet. This sheet shows each individual's spending and available money (or deficit), plus there was an extra column for shared spending stuff that didn't fall easily into any budget category. Subscriptions, random drugstore purchases, family fun or date nights, etc. I would have the starting surplus (or deficit) at the top, add and subtract things throughout the week, and the bottom would show the ongoing surplus (or deficit). Every week I cleared it out, updated the top line and started over.

Well, with only one fixed income, we can no longer be as cavalier with our variable income, which is over half of what the household needs to bring in to make things work. So I adjusted each month's tab in the Annual Budget sheet. Now it lists fixed income, fixed/necessary expenses, and variable/nonessential expenses separately.

The fixed income (my income, the duplex rental) doesn't quite cover essentials, so I wanted to make sure that we covered those first with variable money before we started funding the less essential things. We met as a family and arranged the variables in order of importance, so if we can't fund every item, we'll at least start with funding the more important ones.

Boy this got very long-winded! Anyway, I'm slowly shifting over to the new system. When I pasted the January budget into my Number Crunch, I marked the things in red that aren't funded yet. Now, as we get more variable income, I can fund each item in order of priority.

OK, I realize I have no idea how to upload pics of my spreadsheets with the new system. Darn! Oh well.

Other changes to our budgeting: We didn't have fixed intentional amounts for certain things like Vacays/travel, Home improvement and Giving. And we were putting very little away for the kids' college. I did some calculators and $500 per month seems like a reasonable amount. I'm going to start one of those tax-advantaged college accounts, I forget what they're called, through Vanguard soon and put the money in there.

There are still some random expenses that won't fit under any of the categories I've set up, so we'll just deal with them as they come. AS and NT will have to be a lot more diligent about telling me when they make a purchase and letting me know how they think we should pay for it. I've just been funding random stuff through variable income but now our variable income will be put to such specific uses, there won't be much left over (if any) for randomness, so we need to be much more intentional about incidentals.

Posted in

Uncategorized

|

6 Comments »

December 7th, 2020 at 01:10 am

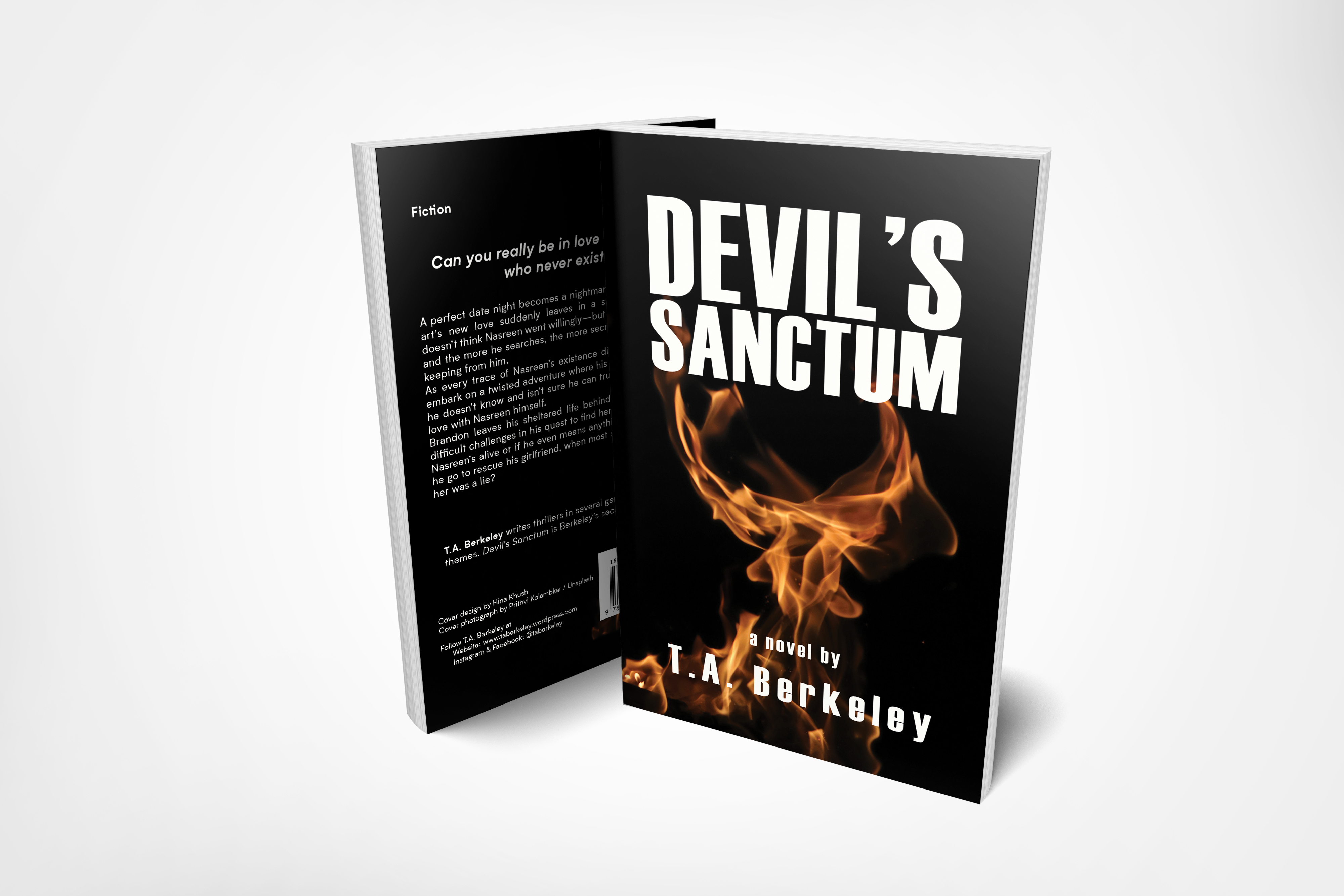

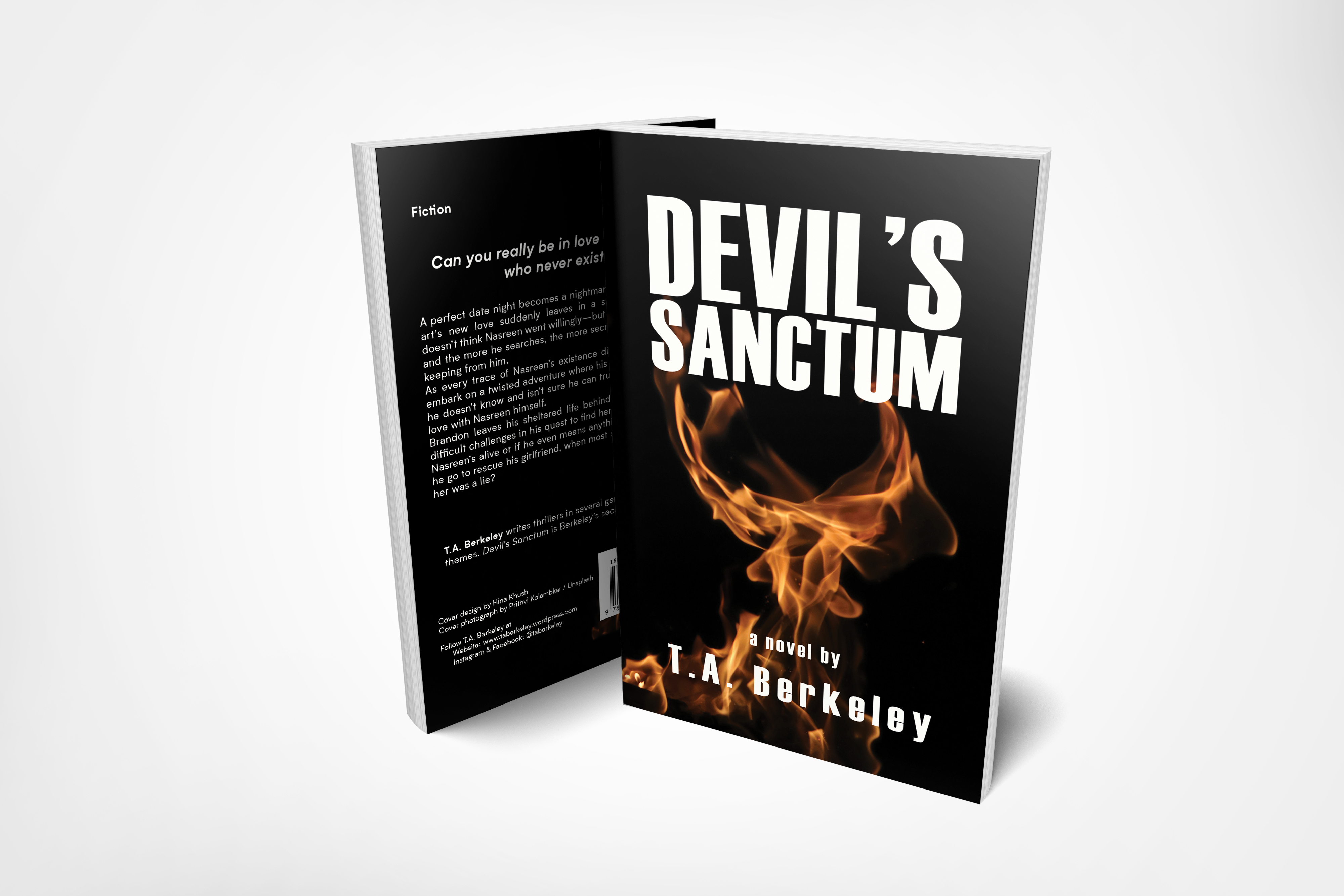

I thought I'd plug my second novel--which I mentioned in my last post--in its own separate post! I'm kind of hopeless at the publicity side of things, which is a bit ironic seeing as how I work in marketing for my full time gig!  But what can I say--I find it easier to talk up others! But what can I say--I find it easier to talk up others!

So here it is. Devil's Sanctum is an action thriller where a man's girlfriend disappears and he has to figure out why, and where she is--and what he didn't know about her true identity. Warning: My fiction is a bit racy and may not be to everyone's taste!

You can order it on any platform that sells books or e-books. I think you can even get your local bookstore to order a copy (it's print on demand so they won't have it in stock). If you're looking for a bit of good trashy fun, I hope you check it out! (My debut novel Viral is also still available everywhere.)

Posted in

Uncategorized

|

6 Comments »

December 2nd, 2020 at 06:49 am

Finally, some progress on the retirement goal!

Goal: $814,292 by March 2024

Current retirement balance: $632,504

July 2020 balance: $565,234

Progress since last update: $67,270

Still needed: $181,788

This interim goal is based on getting my and NT's retirement to 4x my current and his last full-time salary (currently $82,500 and $64,118) by the time we turn 50 and AS's retirement values to 3x her highest annual income ($75,940 in 2018) by the time she turns 45.

$82,500 x 4 = $330,000

$64,118 x 4 = $256,472

$75,940 x 3 = $227,820

It will shift anytime our salary/annual income changes. (The only exception is I won't lower if there's a lower-income year.)

There are 40 months to go before March 2024, so that means we need to gain $4545 per month on average to meet our goal.

The ultimate goal we're working toward is 8x our annual income by the time we retire at 65.

Posted in

Uncategorized

|

4 Comments »

November 30th, 2020 at 03:21 pm

I never got around to calculating last month's net worth, so this represents the change over two months. But holy cow, what a surprise I came back to this month!

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 27,225 pounds ($34,031)

FL: 6,462 pounds ($8,078)

NT's trad. IRA: $97,596

NT's Roth IRA: $54,171

AS's trad. IRA: $24,606

AS's Roth IRA: $79,044

AS's SEP IRA: $57,264

CJ's 401(k): $190,361

CJ's Roth IRA: $59,357

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $592,200 ($630,000 value -6%)

---

TOTAL ASSETS: $1,437,204

Debts:

US Mortgage $373,403

Loan from friends (duplex) $9,000

UK Mortgage 1 $27,163

UK Mortgage 2 $5,726

UK Mortgage 3 $6,030

---

TOTAL DEBT $421,322

Current Estimated Net Worth: $1,015,882

September 2020 estimate: $965,842

Change in net worth (over 2 months): +$50,040

Summary: Wow. We're a net worth millionaire household. I don't even know how to comprehend that!

A little over 13 years ago, in September 2007, I started tracking our net worth, and my initial valuation then was $54,903. Little did I know at the time that our condo had lost a ton of value when the housing bubble burst, so it was probably a lot closer to $0 than I realized. So we've essentially built up a million dollars of net worth in those 13 years.

Notes on the numbers above: House value estimates are usually approximate. UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound.

Posted in

Tracking Net Worth

|

5 Comments »

November 29th, 2020 at 08:01 pm

I've been very off my blogging game. I didn't even do my debt payment and net worth update posts at the beginning of November as I'd normally do! At some point I came on to try and write but that was when the big outage was happening, and I never came back afterward. I've been popping in to at least skim everyone else's entries every week or two, but that's about it.

So what's happened? My brain is all over the place this year, as are most people's I think, and time passes really strangely. Last time I did a real check-in, it was back in early September, shortly after NT had been laid off. So let's see if I can remember the high and low points of my life since then...

- Oh first I should say I self-published my second book! Maybe I'll do a separate post about it at some point. If you're interested, it's called "Devil's Sanctum" and my pen name is T.A. Berkeley. I will warn you my books are pretty racy, so they're not for everyone. :-)

- NT is still unemployed, but we still have his severance funding the budget, so we've been operating fairly normally. He'll also qualify for unemployment starting next month, I believe, so that'll help. He's applied for a few jobs and interviewed for one; he should hear in December whether he's moving on to the next round on that one. He has enough severance to get us through the first week of January. He's been doing a TON around the house, taking on most of the kid care and housekeeping, plus a little freelance work for our downstairs neighbor and for AS's business; she's not officially paying him but his assistance has enabled her to take on more work. I've been helping her as well. She's on track to be the biggest breadearner this year! There is some chance NT could patch together enough income between her, our neighbors and a bit of other stuff to not go back to full-time work, so we're exploring that among our options as we look to next year.

- AS has applied for a few jobs that seem interesting and lucrative enough for her to consider re-entering full time employment! She's also applied for a fellowship that would award $100K to use however she chose to increase her leadership skills and advance her goals. She made it through the first round and will hear about second round results in January.

- My company is doing marginally better. They laid off enough people that we're down to a pretty small staff. They're closing the physical office so we'll be 100% remote even when the lockdown is over. They reversed the temporary paycut, though I'm not sure they reinstated 401(k) matching. I had a chat with one of my former colleagues who's at another agency; he was very interested in bringing me on board. But he doesn't make the hiring decisions and the person who is never got in touch, so I'm not sure if they decided against it or haven't opened up the position at all. I'm happy enough at my job for the time being, so I'm not looking actively.

- The kids are 100% distance learning. We send them to the YMCA three days a week; they take their computers and do school from there. So at least they're around other kids, even if it's not their classmates. They do Monday and Friday at home. They're holding up pretty well, even though they'd rather have in-person school. The teachers are doing an awesome job considering the challenges. The school provides a ton of free food which we pick up on Mondays; we give the meat stuff to friends.

- The kitchen reno is still out there as a possibility, though it's really up to our contractor to make a schedule and let us know the final price tag. He's checked in a couple times and brought an electrician to look at our wonky wiring. We have about $50K saved up and will borrow as much as it takes to get the kitchen the way we want it. We've lived with this terrible kitchen so long, when we redo it, we'll redo it right. I hope it comes in around $70-80K but would probably go up to $100K if that's what it takes. (It'll include mini ductless AC for both floors of our part of the duplex.) This will be our only really big renovation; all the other stuff we want to do on the house will be smaller chunks.

- I've been trying to stay healthy and creative, but time and my headspace are so weird these days, so I've been using some apps to track my habits. It's worked fairly well; I don't think I've gained much weight, if any, and I've gotten a lot of creative stuff done. And kept my drinking fairly under control; that was something I wanted to get a handle on when lockdown started. I just wrote another book for NaNoWriMo, and I have one manuscript out to a couple friends for beta reading. I've also written another song and kept up on my guitar lessons.

- We haven't lost anyone to COVID or caught it ourselves yet, but of course MN is one of the worst states right now. Other than the kids being at the Y three days a week, where they wear masks all day, we have very limited physical contact with people outside the family. Just trying to hang in there and stay safe until a vaccine is available.

- We've more or less kept to our budget this year despite all the weirdness, though we haven't saved anything outside of retirement and whatever goes into the UK account from the rental. And of course NT doesn't have his 401(k) so we're putting less toward retirement. But looking forward, I want to make more of a concerted effort to put money aside. If NT does end up staying freelance/part-time, then we're going to have to treat that variable money as part of our regular budget, which means we'll need to be a lot more intentional about our priorities for funding various budget line items. More on that later; I'm coming up with a new kind of annual budget that will help us be flexible since we have so many income unknowns right now!

Posted in

Uncategorized

|

2 Comments »

October 3rd, 2020 at 04:28 am

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 29,047 pounds ($36,309)

FL: 6,462 pounds ($8,078)

NT's 401(k): $93,680

NT's Roth IRA: $48,994

AS's trad. IRA: $22,594

AS's Roth IRA: $71,675

AS's SEP IRA: $52,334

CJ's 401(k): $169,215

CJ's Roth IRA: $53,734

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $592,200 ($630,000 value -6%)

---

TOTAL ASSETS: $1,389,309

Debts:

US Mortgage $375,000

Loan from friends (duplex) $9,000

UK Mortgage 1 $27,546

UK Mortgage 2 $5,806

UK Mortgage 3 $6,115

---

TOTAL DEBT $423,467

Current Estimated Net Worth: $965,842

July 2020 estimate: $972,273

Change in net worth: -$6,431

Summary: Considering our net worth jumped about $40K over the past two months, and with all the chaos of late, not really surprised we lost $6K this past month. The loss may have been offset by this month's Roth contributions coming through; I'm not really sure.

I've requested automatic debit for our new mortgage but didn't get any notice it had been set up, so we mailed a check on the 30th. It'll definitely get to them before the 15th so I'm not worried, but it's weird not to have a US mortgage payment go through in the first couple days of the month!

Notes on the numbers above: House value estimates are usually approximate. UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound.

Posted in

Tracking Net Worth

|

1 Comments »

September 2nd, 2020 at 04:25 pm

Have you read that kids' book? I think it has another title too. Basically the character has very good luck and very bad luck every other page. I think about that book a lot lately because that's how 2020 feels. Every time something good happens, something terrible cuts short any sense of celebration.

Some of them are smaller things, but some are bigger. I never feel like I can relax for long.

Our youngest kid has had to get two COVID tests, once for a fever and once for a possible exposure at her summer camp. She tested negative both times, thank goodness. (Of course both negative results were shortly followed by some terrible news or event, but they're all starting to run together so I can't remember which they were.)

One really bad piece of news is that NT was laid off from his job last week. Very unexpectedly; it seemed like business was picking up. They'd already given everyone a temporary 20% paycut so it seemed like they were doing what they needed, but apparently they needed to do more. Several other people were laid off too.

He'd been with the company for 13 years, nearly as long as he'd been eligible to work in the U.S. The layoff itself was cold and awful, conducted via Zoom. But at least he's getting 13 weeks of severance pay, which should come in a couple weeks. So we'll be good through the end of the year. Even if I get laid off (which we all thought was much more likely), I'll get the same, so we'll still be good through December.

He's taking some time to clear his mind, do some stuff around the house, and help AS with her business. He isn't actively looking for a job yet but he does have a lead on one from a former coworker, so he's following up on that one.

Although it was obviously VERY unwelcome news, one silver lining is that it didn't happen while we were going through the refi! I'd been holding my breath hoping not to get laid off during it; it never occurred to me to be worried about his job.

So one piece of very good news is that the refi went through, and it ended up being much more beneficial financially to our actual budget than predicted. Here's the real budget impact:

Appraisal (478.00)

Estimated closing costs + wire fee (11,789.72)

Refund after closing costs ended up being much less: $9626.06

No Sept mortgage payment: $3254.50

Escrow refund: $5766.82

So overall, the refi had an immediate benefit to our budget of $6379.66!

Now when it seemed closing costs were ballooning to $16K due to insurance & tax stuff, I had them roll $5K into our new mortgage. If we hadn't done that, the real budget benefit would have been $1379.66. Still pretty great!

And our new mortgage, which we start paying in October, is about $300 less per month than our old one, so the benefit to our budget will continue. We got a 25-year loan, so it doesn't add any time to our payoff schedule either.

Many other good and bad things have happened in our lives and in our community, but those are the biggies in terms of actual impact to our day-to-day life. I'm sure 2020 has many more surprises, nasty and nice, waiting for us.

Posted in

Uncategorized

|

10 Comments »

September 2nd, 2020 at 04:05 pm

I don't have a US mortgage payment this month, in fact added nearly $5k to my principal due to the refi. (More on that in a separate post.) But our UK mortgage payments went through:

UK1: $192

UK2: $42

UK3: $43

So just $277 went toward principal this month.

Posted in

Uncategorized

|

0 Comments »

September 2nd, 2020 at 03:42 pm

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 29,047 pounds ($36,309)

FL: 6,462 pounds ($8,078)

NT's 401(k): $96,078

NT's Roth IRA: $49,313

AS's trad. IRA: $23,169

AS's Roth IRA: $72,591

AS's SEP IRA: $50,695

CJ's 401(k): $172,906

CJ's Roth IRA: $54,182

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $592,200 ($630,000 value -6%)

---

TOTAL ASSETS: $1,396,017

Debts:

US Mortgage $375,000

Loan from friends (duplex) $9,000

UK Mortgage 1 $27,738

UK Mortgage 2 $5,848

UK Mortgage 3 $6,158

---

TOTAL DEBT $423,744

Current Estimated Net Worth: $972,273

July 2020 estimate: $952,110

Change in net worth: +$20,163

Summary: Jeez, even with adding almost $5K in debt due to the refinance, our net worth jumped again this month. I think we've gained $40K in retirement value over two months, which is, yeah, not going to be a lasting gain. I wonder if we'll reach a million in net worth before the bubble bursts?

Notes on the numbers above: House value estimates are usually approximate. UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound.

Posted in

Tracking Net Worth

|

2 Comments »

August 4th, 2020 at 03:37 pm

This month's mortgage payments have gone through:

US: $778 to principal

UK1: $191

UK2: $40

UK3: $42

All told that's $1051 to principal this month.

Here are our current household debt totals (although we know they'll shortly be going up since I rolled some of the closing costs into the refi):

US Mortgage $368,029

Loan from friends (duplex) $9,000

UK Mortgage 1 $27,738

UK Mortgage 2 $5,848

UK Mortgage 3 $6,158

-----

TOTAL DEBT $416,773

Posted in

Uncategorized

|

0 Comments »

August 2nd, 2020 at 05:20 pm

We are hopefully nearing the end of the refi...this has been the least stressful one I've ever experienced. The AIMloan people are very responsive and clear, and also we have so much money in savings that it hasn't freaked me out when the closing costs kept ballooning.

The cost from the lenders has stayed steady but somehow we're having to pay 12 months of homeowner insurance, 6 months of property tax, plus put 4 months' worth of each into the escrow. So rather than the $2400 I was expecting, I've initiated a wire transfer for $11,759.72!

I've saved up about $4K to cover this, and we can float the rest for a couple months while I see how much we get refunded from our current mortgage company. I'm thinking our August mortgage payment will pretty much get fully refunded plus whatever we have in our escrow there, but since I really really don't understand mortgage math, I'm not going to speculate too much.

Also, once the new mortgage starts up, it'll be $300 less per month, so that will help us make up the difference. Worse comes to worst, we have plenty of money set aside for the kitchen reno and who knows when that'll actually start up.

So anyway, the wire transfer should be completed Monday, and our signing is Wednesday. We don't actually have an appointment but the AIMloan rep says they'll assign us a notary, so I assume we'll hear from them and we'll set up a time for them to come over.

After that I don't know how long it'll take for everything else to finish up, but AIM has been good about communicating each step, so I'm fairly confident they'll guide me through the last few bits. Fingers crossed!

Posted in

Uncategorized

|

3 Comments »

July 31st, 2020 at 07:10 pm

Finally, some progress on the retirement goal!

Goal: $814,292 by March 2024

Current retirement balance: $565,234

January 2020 balance: $542,038

Progress since last update: $23,196

Still needed: $249,058

This interim goal is based on getting my and NT's retirement to 4x our salaries (currently $82,500 and $64,118) by the time we turn 50 and AS's retirement values to 3x her annual income ($75,940 in 2018) by the time she turns 45.

$82,500 x 4 = $330,000

$64,118 x 4 = $256,472

$75,940 x 3 = $227,820

It will shift anytime our salary/annual income changes. (The only exception is I won't lower AS's if she has a lower-income year, because her income fluctuates. So I'm keeping it at the 2018 level because her 2019 income was a little less.)

NOTE: I'm in a weird position because I got a 10% raise in February but a 10% "temporary" paycut in May. I decided to base this on my new salary of $82,500 instead of my old (and current "temporary") $75,120 salary. But that may change. I don't know. I'm still thinking about it. But that of course puts us farther behind because our goal is now that much more ambitious. (NT has also taken a "temporary" 20% paycut but we hope that will end in September, so I'm keeping him at his stated salary.)

There are 44 months to go before March 2024, so that means we need to gain $5660 per month on average to meet our goal.

The ultimate goal we're working toward is 8x our annual income by the time we retire at 65.

Posted in

Uncategorized

|

1 Comments »

July 31st, 2020 at 06:55 pm

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 29,047 pounds ($36,309)

FL: 6,462 pounds ($8,078)

NT's 401(k): $92,548

NT's Roth IRA: $46,606

AS's trad. IRA: $21,978

AS's Roth IRA: $68,610

AS's SEP IRA: $47,913

CJ's 401(k): $163,988

CJ's Roth IRA: $51,208

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $592,200 ($630,000 value -6%)

---

TOTAL ASSETS: $1,369,934

Debts:

US Mortgage $368,807

Loan from friends (duplex) $9,000

UK Mortgage 1 $27,929

UK Mortgage 2 $5,888

UK Mortgage 3 $6,200

---

TOTAL DEBT $417,824

Current Estimated Net Worth: $952,110

June 2020 estimate: $758,303

Change in net worth: +$193,807

Summary: Wow, thanks to the higher-than-expected home appraisal, we're suddenly nearing net-worth-millionaire status! Our retirement accounts were all up a fair bit too--maybe $20K? So that helped too!

If our refi goes through we'll add about $5K to our debt next month, so I don't expect to keep at this level. I'm also thinking the stock markets can't hold out against the recession forever, so those could tank at any time. Still, this is a nice number to see!

Notes on the numbers above: House value estimates are usually approximate. UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound.

Posted in

Tracking Net Worth

|

0 Comments »

July 24th, 2020 at 09:15 pm

We're still in the refi process, but it does appear to be moving toward completion. AIMloan is a much more orderly broker than the person we worked with for our last two big mortgage actions (buying our current home and refinancing it).

I don't claim to understand everything about how refis work, but despite having to bring a lot more to the table than expected, it still feels like we're getting a good deal. Here's what's happened:

- They noted we'd have to bring over $13K to closing (or is it $14K or $15K? I have such trouble understanding the magic math of mortgages), despite having quoted closing costs of $2400. Say it's partly to prepay 4 months of interest, insurance and taxes into the escrow, and partly because our annual insurance bill is coming due. We have the cash on hand but since we still want to do a kitchen reno at some point, I asked them to roll $5K of it into the loan.

- In addition to rolling $5K into the loan, I believe we'll get $3700 returned to us from the existing mortgage's escrow account, and I have $3500 set aside for the refi. The very highest closing number I'm seeing (I can't tell if that's what we'll actually need) is $15,619. So that means the most we'd have to come up with, net, is $3419.

- Our home appraised for $630K (vs the $500K I estimated)! This means even with the additional $5K, our LTV is 59%. Our agent says this means a $937 drop in closing costs. So maybe the most we'll have to come up with is $2482?

- AIM also says there's a $1473 "aggregate adjustment" coming our way but I can't tell if that's already factored into the numbers. It also seems like the loan is based on a higher principal amount than what we owe, but maybe I'm reading things wrong. It's all so confusing! It does appear that the closing costs they're charging are staying the same and that the other fluctuations are due to escrow, insurance etc., so I'm just trusting the process at this point. Luckily we have plenty of money in savings.

- Right now it seems like we're just throwing tons of money at the refi, but in the long run, we should get a monthly payment that's $300 less than what we pay now, for the same payoff period we had before, so if that happens, I'm happy. Anyway, we do have expensive homeowner insurance and property taxes, so it kind of just is what it is I guess.

- I let our neighbors know about the appraised value and they said they're meeting with an accountant to get all their tax stuff worked out! If that happens, we'll start to explore the possibility of co-owning the home again. I had all but dismissed that idea forever because I thought they'd never clear out their unfiled tax returns. My neighbor said he's thinking we should do a trust where the home is owned among us but goes to our kids. (They don't have kids and they're our kids' godfathers so they want to leave their portion to them.) So we'll see how that all pans out. Definitely will be making sure there are no unfiled taxes and also will get a second opinion from another lawyer to make sure there aren't any pitfalls we're not considering.

Posted in

Uncategorized

|

3 Comments »

July 2nd, 2020 at 04:52 pm

Mortgage payments hit:

US: $776 to principal

UK1: $191

UK2: $40

UK3: $43

That's a total of $1,050 of debt paid.

New household debt totals:

US Mortgage $368,807

Loan from friends (duplex) $9,000

UK Mortgage 1 $27,929

UK Mortgage 2 $5,888

UK Mortgage 3 $6,200

---

TOTAL DEBT $417,824

Posted in

Uncategorized

|

1 Comments »

July 1st, 2020 at 05:16 am

It's been a month and a half since my previous post about what COVID has done financially to our household. What a wild ride it continues to be! At least my mental health seems to be settling into a more stable place; not happy, but more accepting that it's going to be a long long time before things get back to anything resembling normal.

Anyway, money stuff:

- Salary. Last time I wrote, NT had seen a 5% paycut. Now, the paycut for him is 20%. The bonus is, he gets Fridays off. I also now have a 10% paycut. I consider that lucky since 6 of our approximately 36 staff were cut last week. My workload is abnormally light so I don't at all feel secure in my position, but for now I'm still in it. At least AS's freelance business is still going strong!

- Net worth. As detailed in my previous post, our wealth has essentially stagnated since January. I know we're some of the luckier ones to even be able to hold the line, so I can't complain, but it's not a great feeling either to not be making any progress.

- Refi. After dithering for years about a refi, I suddenly bit the bullet and applied for one last night! We're preliminarily approved so we'll see how it goes. I've noticed I'm more willing to make sudden changes in my thinking during this whole crisis, so I do think this is a COVID impact. If all goes well and if I understand correctly, we'll spend about $3400 for a 25-year mortgage that's about the same P&I as our current 30-years, and no mortgage insurance should take us down a few hundred bucks a month, so if I understand the costs right, it should pay for itself in 6-9 months.

- Technology. Last time I reported we bought two Chromebooks for the kids' distance learning. Since then we've also purchased a Nintendo Switch to have some new games to help distract us. About $350 total for the system and a starter batch of games.

- Dependent care flex spending. Last time, I mentioned stopping contributions because it seemed like all summer care options were being canceled. Well, in the end three options did decide to open, so we'll be incurring some daycare expenses without the immediate tax benefit. I could have started up my contributions again but thought, what if there's an outbreak that forces the camps to close? What if one of us gets COVID and we all need to quarantine? So I decided not to. We did change the summer care schedules to just four days a week, and on Fridays NT entertains the kids, or we let them lounge around on screens if he's busy with errands or whatever.

- The UK flat. Early this year (January or February), we decided that Brexit had settled down enough to list our flat for sale, so our management company gave our renters notice. Then COVID hit. Technically the flat is still on the market, but we found new renters who signed a year lease, so anyone who bought it would have to take it over with them in situ. I'm glad we have renters to cover the mortgage, property taxes etc. though, even if it means even less chance the flat will sell anytime soon. We only missed one month of rent after all that, amazingly; the old renters moved out 5/31 and the new ones move in tomorrow.

- Regular household expenses. Last time, we hadn't used the bus in over a month. Since then, we have used it a few times to get the kids to daycare or to go to a store, but the buses have the front blocked off to protect the driver, so there's no way to use our bus passes. So we continue to save on that regular expense.

- Going out/shows. Last time I reported I'd gotten refunds from loads of canceled shows. Since then, I've bought a few concert tickets, for a late October show and two May 2021 events. I also continue to tip musicians whose livestreams I watch, because they're still working hard, and they need all the help they can get.

- Travel. Of the 4 air trips and 1 road trip we had booked before the pandemic hit, all have been canceld (either by us or the airline) except 1 air trip (sending the kids on their first parent-free flight to see my sister in Va.).

* We got airline credits for two of the three flights and a full refund for the one hotel that had been reserved.

* The big airfare, the one to UK, was fully refunded without us even requesting. That $5K was a balm to our budget and wiped out our shared-spending deficit. In different times I might've tried to save the cash for a future time, but...you know.

* We did however book two NEW trips: road trips to lakes to replace two of the canceled trips. A road trip to a secluded rental house is much less risk than a touristy destination.

* We are waiting to decide on the kids' trip to Va. but from what I've read, planes are not that risky comparatively, and my kids are well, well trained on safety and social distancing. MN and Va. are so far controlling the spread pretty well, so if that keeps up, we may go through with that trip.

Posted in

Uncategorized

|

4 Comments »

July 1st, 2020 at 04:34 am

Assets:

NT's UK pensions:

AV: 22,397 pounds ($27,996)

SW: 29,047 pounds ($36,309)

FL: 6,462 pounds ($8,078)

NT's 401(k): $88,673

NT's Roth IRA: $43,474

AS's trad. IRA: $21,004

AS's Roth IRA: $64,468

AS's SEP IRA: $45,695

CJ's 401(k): $153,837

CJ's Roth IRA: $47,862

NT's flat: $212,500 (200,000 pounds value x1.25 -15%)

CJ/NT/AS house: $427,281 ($454,554 value -6%)

---

TOTAL ASSETS: $1,177,177

Debts:

US Mortgage $369,583

Loan from friends (duplex) $9,000

UK Mortgage 1 $228,120

UK Mortgage 2 $5,928

UK Mortgage 3 $6,243

---

TOTAL DEBT $418,874

Current Estimated Net Worth: $758,303

May 2020 estimate: $743,824

Change in net worth: +$14,479

Summary: Our net worth finally surpassed our previous high which was way back in January. Five months later we have gained $545 in wealth. (And I'm certainly not counting on this amount.) I'm not going to do a retirement progress update yet though, because we've paid off about $5K in debt in those months, so I know overall our retirement accounts are still off their January highs.

I will be interested to see if our appraisal for the refi we're attempting will turn up a higher home value than what I have. But again, considering how weird everything is right now, not really counting on anything.

Notes on the numbers above: House value estimates are approximate. (I do have my eye on a comparable listing for the UK flat, but it's been on the market a long time.) UK pension values updated about once a year. UK asset values and debt amounts are calculated figuring $1.25 for every British pound.

Posted in

Tracking Net Worth

|

1 Comments »

June 29th, 2020 at 07:11 pm

Our mortgage lender sent a refi offer -- they FedEx'ed it which was a good ploy to get me to open it.

I like the rates they mention and that there are fewer fees. Plus it would be a chance to eliminate our mortgage insurance, which we're stuck with for the life of our loan regardless of LTV.

But they slapped this chart on the mailing and I'm totally confused. The new scenario shows a new loan amount that's over $120K lower than our current principal balance.

So what I'm trying to figure out is, why are they showing that lower amount? Are they trying to say we'd have to pay down to that amount to qualify for the refi? Or are they being sneaky and pretending this offer will save way more money than it actually would if I refi'ed the entire principal amount?

Either way, is this sneakiness concerning enough that I shouldn't even reach out to them? I didn't choose this lender; when we refi'ed, the lender sold our loan to this company. We haven't had any problems with them but don't really know anything about them either.

Posted in

Uncategorized

|

6 Comments »

|

But what can I say--I find it easier to talk up others!

But what can I say--I find it easier to talk up others!